Unveiling Leadership Wisdom: 40 Years, 20 Mentors, Countless Lessons

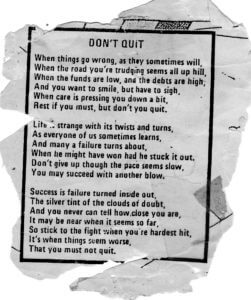

Over the years, I made notes on what I learned from people I reported to or provided some much-needed guidance. There were plenty of leaders, managers, and “supervisors” over the forty years some worth remembering, some not, but they all had made some contributions, good, bad, or indifferent. I came up with a summary list of people who had left enough of an impact which helped create an ever-evolving leadership style and capacity for growth. In chronological order, is a brief description of what I learned from fifteen highly effective leaders, three nice yet, ineffective supervisors, and two truly horrible, douchebag bosses. I no longer wonder how a couple of dimwit nincompoops got their jobs, but I keep them on the list for amusement purposes only.

A big heartfelt thank you to all of the highly effective leaders that I worked with. You all made a tremendous difference that has lasted a career cycle and a lifetime. Even more, as I passed some of your leadership practices and lessons to my direct reports over the years.

There’s a story behind each that might someday make it in a possible book in the future. Some readers might recognize the distinct names and unique and endearing characters and I request for the sake of discretion please consider that your comments are in the public domain.

It’s been an interesting exercise and highly recommend that you give it a try to discover a few of the origins of your your habits and patterns. Visit your list on occasion or when someone triggers a forgotten memory and write it down.

Lessons From the Masters In My Working Career

Continue reading “The Leadership Roster”

Going paperless offers convenience and flexibility when it comes to managing bills and financial statements. I remember the days of getting my monthly 10+ page bank statement in the mail and using it to balance my checkbook. At one time, before computers and scanners, the bank would actually send your canceled checks back to you to where you stored them and referenced them for your income tax preparation. I had a file cabinet for managing all of these paper statements that came through “snail mail” which used to include credit card bills, utility, mortgage, property tax etc. There used to be quite the paper trail. Today, going online eliminates the paper and more importantly allows one the option to monitor things in real-time. Here’s the downside:

Going paperless offers convenience and flexibility when it comes to managing bills and financial statements. I remember the days of getting my monthly 10+ page bank statement in the mail and using it to balance my checkbook. At one time, before computers and scanners, the bank would actually send your canceled checks back to you to where you stored them and referenced them for your income tax preparation. I had a file cabinet for managing all of these paper statements that came through “snail mail” which used to include credit card bills, utility, mortgage, property tax etc. There used to be quite the paper trail. Today, going online eliminates the paper and more importantly allows one the option to monitor things in real-time. Here’s the downside:

Every six months or so I prepare to negotiate what I am paying for my satellite TV and internet/phone service. When the previous “promotion” ends, the monthly rate will change, usually after 6 months. When that happens I would call up and politely complain that my price increased and ask, politely, to return me to the promotional rate. The professional agents would ask a few questions and reply that the specific promotion has ended and I am now going back to the regular rate schedule which is about 22% more. I would thank them for their time and asked to be transferred to the customer loyalty department which they will do, sometimes reluctantly.

Every six months or so I prepare to negotiate what I am paying for my satellite TV and internet/phone service. When the previous “promotion” ends, the monthly rate will change, usually after 6 months. When that happens I would call up and politely complain that my price increased and ask, politely, to return me to the promotional rate. The professional agents would ask a few questions and reply that the specific promotion has ended and I am now going back to the regular rate schedule which is about 22% more. I would thank them for their time and asked to be transferred to the customer loyalty department which they will do, sometimes reluctantly.  If you’ve been surfing around my blog, you’ve come across the expense tracking sheet and the FIRE Calculator. (Financial Independence Retire Early). I’ve recently come across another fabulous calculator that will run models to provide you a line of sight to when you are going to hit a financial goal. Here’s how easy and painless it is. All you have to do is enter the following inputs: (You’ll need a Google Account, to access the workbook).

If you’ve been surfing around my blog, you’ve come across the expense tracking sheet and the FIRE Calculator. (Financial Independence Retire Early). I’ve recently come across another fabulous calculator that will run models to provide you a line of sight to when you are going to hit a financial goal. Here’s how easy and painless it is. All you have to do is enter the following inputs: (You’ll need a Google Account, to access the workbook).

I had a couple of millennials on my team during my Manager/Leader years, and they are a completely different than my generation in the best possible way. The speed and efficiency with which the millennials can process complex technical information that boggles my mind. They are blank slates and their brains are like sponges that absorb all kinds of information and stimuli. We all have to be conscious to filter a few things that we say and do just a little bit, as most of us have twenty-plus years of experience and these folks have just three. They do take things at face value and yet don’t have the experience to read between the lines or learn how to filter some of the chatter that goes on. I’m happy to report, that this has not changed from the time some of us were twenty-somethings ourselves. I’ll leave working and training millennials alone for the moment as I’m still trying to develop best practices without sounding like a parent. There are exceptions though, and one of those topics that are covered in the theme of this blog.

I had a couple of millennials on my team during my Manager/Leader years, and they are a completely different than my generation in the best possible way. The speed and efficiency with which the millennials can process complex technical information that boggles my mind. They are blank slates and their brains are like sponges that absorb all kinds of information and stimuli. We all have to be conscious to filter a few things that we say and do just a little bit, as most of us have twenty-plus years of experience and these folks have just three. They do take things at face value and yet don’t have the experience to read between the lines or learn how to filter some of the chatter that goes on. I’m happy to report, that this has not changed from the time some of us were twenty-somethings ourselves. I’ll leave working and training millennials alone for the moment as I’m still trying to develop best practices without sounding like a parent. There are exceptions though, and one of those topics that are covered in the theme of this blog.

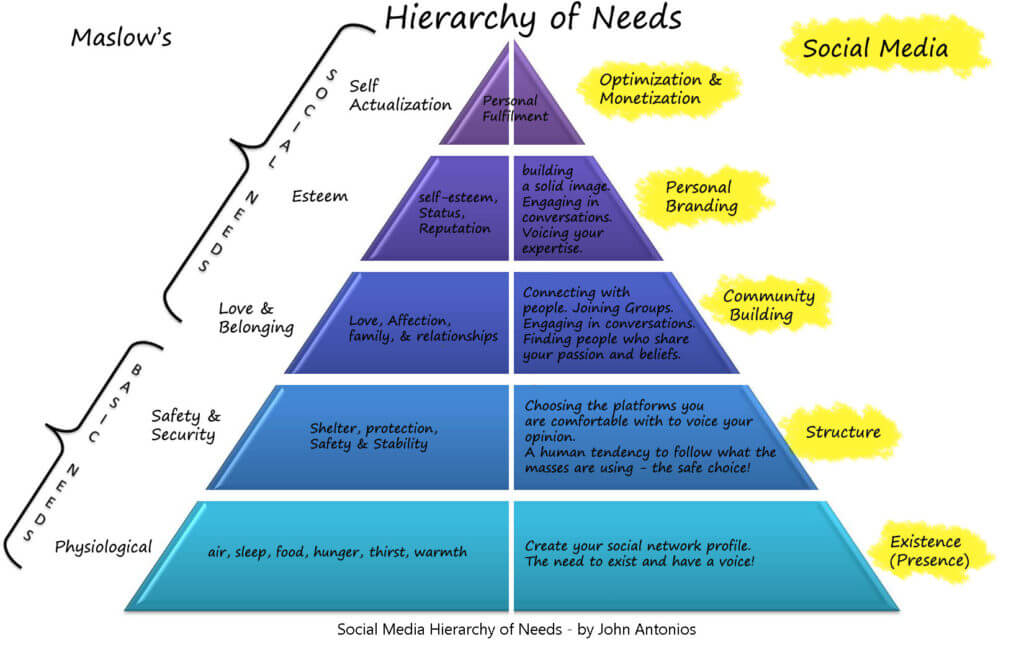

Here’s a new twist on a familiar theory from B-school that is still valid today as it is applied to Social Media. The social media hierarchy mirrors the original theory beautifully. In 1943 Abraham Maslow published a paper describing the human theory of motivation. It describes basic interdependent stages of human growth through the achievement of psychological needs.

Here’s a new twist on a familiar theory from B-school that is still valid today as it is applied to Social Media. The social media hierarchy mirrors the original theory beautifully. In 1943 Abraham Maslow published a paper describing the human theory of motivation. It describes basic interdependent stages of human growth through the achievement of psychological needs.

Leo Buscaglia was an author and motivational speaker, who at the time. focused on personal relationships. He was often referred to as Dr. Love. His work and message still endure today. He authored fourteen books and coined a valuable question that his father asked him every day when he was a child: “What have you learned today?”. It’s an interesting question to ask yourself at the end of each day.

Leo Buscaglia was an author and motivational speaker, who at the time. focused on personal relationships. He was often referred to as Dr. Love. His work and message still endure today. He authored fourteen books and coined a valuable question that his father asked him every day when he was a child: “What have you learned today?”. It’s an interesting question to ask yourself at the end of each day. Who doesn’t like a good book that you’ve enjoyed reading and learned a few nuggets of knowledge from the author? Case in point,

Who doesn’t like a good book that you’ve enjoyed reading and learned a few nuggets of knowledge from the author? Case in point,