]

Save some, spend some, invest some

I’ve been working on my tax return for the past couple of weeks. I’m still waiting for Charles Schwab to release the 1099’s. They are always the last to report my financial statement to me. What’s up with that?

During my TurboTax income “questionnaire”, I’m always pleased with the small efforts that I put in throughout the year to track my expenses to the nearest penny. My year-end roll-up makes doing taxes just more palatable since I keep track of the necessary docs to get taxes done quickly and easily.

During this time of year, I also have a look at my Historic Savings Rate which goes back to 1998 along with my expense tracking sheets when I started down the personal finance road.

While looking through my files, I came across these pictorials of graphs that I found quite fascinating. Now, if you’ve been following along this blog for a while, you may have noticed that my tagline states: “My hindsight can be your foresight.”

It goes in the same vein as what Steve Jobs said about connecting the dots.

“You can’t connect the dots looking forward; you can only connect them looking backward. So you have to trust that the dots will somehow connect in your future.”

Steve Jobs

Well, the future showed up.

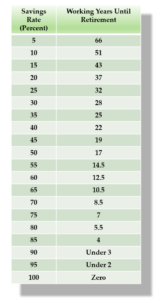

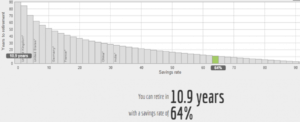

The Saving Rate Chart and graph connected the dots for me.

The simplicity and accuracy of the calculations are astounding.

The Shockingly Simple Math (Mr. Money Mustache).

The Shockingly Simple Math (Mr. Money Mustache).

The blog piece that started the personal finance FIRE movement originates with Mr. Money Mustache called “The Surprisingly Simple Math Behind Early Retirement”. Click the hyperlink to read the original article.

Decisions happen in an instant, and the first step is usually the most challenging.

Bottom Line #1.

It’s an easy process, but a long process.

Whether you want to drag it out for 35 years or whittle it down to 10 or 15 years, it’s entirely up to you. Either way, there are always compromises, sacrifices, and a price paid. Upfront made the most sense for me.

Bottom Line #2.

The race is long, and in the end, it’s against yourself.

So fellas, ya, you two. Read the Mr. Money Mustache article recalibrate, and stay on track.

Your future self will thank you and you can count on the dots connecting on your terms.